During the early stages of launching your online store, you’ll need to make a number of critical decisions. Perhaps the most important of these is the way in which you’ll process your customer payments. You can choose to process the orders yourself using a true merchant account, or use a third-party processor. The method that you decide on could affect the implementation of your entire web site.

But how do you choose? Is price the single most important factor? What other factors are involved? In this article, we’ll uncover the answers to these questions by comparing a true merchant account to third-party processors. We’ll expose the differences between the two methods by comparing them side-by-side in real world examples, using a custom-built PHP calculator to aid us in our quest. Let’s not waste any more time!

The Basics

Before we dive into the comparisons, let’s take a closer look at these two methods. With a true merchant account, you, the merchant, apply with a processing bank (usually through a sales agent) for the right to have a merchant account dedicated solely to your business. The merchant account is for your business alone and you are responsible for it in every way. You’re also responsible for providing a gateway to it, as this is not included with the account. (While some processing companies or sales agents will bundle a gateway with the merchant account for convenience, they’re separate entities and you’re usually free to use any gateway that you prefer). Basically, your merchant account is a direct account with Visa and Mastercard (and American Express and Discover Card, should you choose to accept payments from their members), so you must abide by their rules.

A third-party processor allows businesses and individuals to accept credit card payments through its own merchant account. Instead of applying directly through a processing bank, you apply through the third-party processor, which uses its own set of criteria to decide whether or not you’ll be eligible to use their services — the third party processor’s bank doesn’t even know you exist! A payment gateway of some form is automatically included as you must process all sales through the third-party processor’s system. The third-party processor holds all the cards, as they make all the rules by which you must abide, and they will hold you responsible for how your transactions affect their merchant account (the one that they’re allowing you to share).

When to Consider a Third-Party Processor

When access to a true merchant account is impractical or impossible, a third-party processor is the obvious choice. When would this be the case? In situations such as those that follow.

- The applicant is unable to acquire a true merchant account. Not everyone who wishes to accept credit cards is eligible for a true merchant account. Reasons for this may be:

- The applicant is not a registered business. The four major credit card groups (Visa, MasterCard, American Express, and Discover Card) require that all applicants are legally registered businesses. Individuals are not allowed to process credit cards for personal use — this includes using their business’ merchant account for personal use.

- The applicant has been blacklisted. The Match File, also known as the Terminated Merchant File, is the blacklist of the credit card processing industry. If you’re on this list, chances are that you won’t be able to establish a merchant account until you’ve rectified whatever caused you to be added to the blacklist.

- The applicant poses a high risk. Accepting credit cards online is a risky proposition. Fraud rates involved with online credit card payments are substantially higher when compared with traditional retail establishments. Certain types of merchandise may also pose a higher risk than others, such as electronics and other high ticket items. Combine a high risk item with the high risk Internet environment, and establishing a merchant account for your business suddenly becomes very difficult.

- The applicant’s personal credit is questionable. As risk is the single most important factor in the world of merchant accounts, personal credit becomes a major factor in a merchant’s ability to establish an account. Since new businesses typically don’t have established credit, merchants must use their personal credit to support the business. It’s likely that merchants who have no credit or poor credit won’t be able to secure a merchant account, and if they do it will be one with prohibitively high rates.

Other Points to Consider

Besides the key points that we’ve just talked about, there are other elements to keep in mind when considering a third-party processor.

- Third-party processors do not perform credit checks.

- They’ll usually accept high risk businesses without higher rates.

- Rates are not negotiable.

- They can not be used with a separate processing gateway.

- The third party processor’s name appears on your customers’ credit card statements.

- You can discontinue the relationship at any time without incurring a penalty.

- It can take up to one month to receive any deposited funds.

When to Consider a True Merchant Account

When the idea of accepting credit cards online is posed to them, most merchants assume that they’ll need a merchant account with a payment gateway. There’s a good reason for this assumption, as all reputable online merchants use true merchant accounts. The reasons for this include:

- Large volumes of transactions are processed. Although true merchant accounts incur fees that are not otherwise associated with third-party processors, merchants who process large volumes of transactions will pay less with a true merchant account because they’ll receive a better discount rate. The discount rate paid to a third-party processor can be as high as 6.00%, with a transaction fee of a dollar or more. A true merchant account can offer rates less than half this. As a result, a merchant’s savings with a true merchant account grows as the volume of transactions made on their account rise. Large volume merchants will easily clear the threshold that makes a true merchant account a financially superior option.

- Merchants have total control over the account. Since you’ve opened the merchant account specifically for your business, you have total control over it. It’s your name that appears on the credit card statements of your customers, you deal with customer support directly, and you have more freedom as to how you can use the account. Third-party processors tend to set rigid rules as they risk losing their merchant account if it’s determined to facilitate too many rule violations.

- Merchant accounts offer transparent checkout. Most gateways offer an API (Application Programming Interface) for interacting with their services. This allows a programmer to communicate with the gateway directly from the merchant’s web site instead of taking the customer to the gateway’s web site and then back again. The transaction appears to be processed directly on the merchant’s web site, alleviating the problem of customers leaving the web site because they don’t feel comfortable with the purchase process.

- Merchant’s portray a more professional image. Most customers have a preconceived notion of what a professional website is. In the scope of this article, this means a seamless checkout process with pages that have the same look and feel as the rest of the website. It also means never leaving the website to complete the transaction. Using the API of a true merchant account allows you to achieve a transparent checkout that maintains the air of professionalism that’s expected from your customers.

Other Points to Consider

- In applying for a true merchant account you’ll undergo a full credit check.

- A merchant account can’t be used for personal use.

- High risk businesses will pay much higher rates.

- Rates are negotiable.

- A merchant account can be used with a separate processing gateway.

- Your business name appears on your customers’ statements.

- You may be locked into a multi-year contract.

- Funds are usually deposited within 1-3 business days.

Side-by-side Comparison

Okay, so we’ve established that there are quite a few differences between a true merchant account and a third-party processor. These differences are ultimately what cause the merchant to choose between the two methods, as one or the other will fulfill his or her specific needs. However, we’ve only skimmed the surface of the primary factor that influences a merchant’s decision: cost. I’m not saying that the other points that we talked about aren’t important — they are, and certainly weigh in on the final decision — but most ecommerce startups have tight budgets and small margins, and for them, cost is the single most important factor in choosing a payment method.

What better way to work out the most cost-effective method than comparing all the methods to see which is best for your business? Sounds great, right? But what do you need to compare? Can you name all of the third party providers that you might consider using?

Enter: the php calculator. To ease the task of comparing a true merchant account to a third party processor, I’ve rounded up the rates and fees of the more popular third-party processors and thrown them into a user-friendly interface that will allow you to work out which is the most cost-effective method for you. You can access the calculator here. Feel free to use this calculator to follow on with the comparisons that we’re going to make, and to make your own comparisons.

The Goals of the Comparison

It’s fairly difficult to compare apples with apples in this case because the needs of each business will vary, as will the offers that they receive. Instead, we’ll take the core principles that are involved in a cost comparison and use these to get an idea of where each provider stands in relation to the others.

We’ll do more than just scratch the “whose rate is lower?” surface, looking closely at the factors that every business should consider: their short and long term costs. Our cost comparison will not only look at the monthly costs associated with accepting credit cards online, but also at the costs incurred before a merchant can begin accepting the cards, through to their annual cumulative costs.

Getting Started

Before we can make a successful comparison, we’ll need to collect some sample data, namely the fees associated with true merchant accounts and third party processors.

- setup fee: how much you need to pay to establish the account

- discount rate: the percentage of sales that the processor takes

- transaction fee: the flat fee the processor charges for each transaction

- monthly fee: the monthly fee associated with keeping the account active

- gateway setup fee: the cost to set up a gateway

- gateway monthly fee: the monthly fee charged by the gateway provider for use of their payment gateway services

Now we know what to expect in our quote from a true merchant provider. To make a proper comparison, we only need two pieces of information from our business:

- average transactions per month: the number of transactions that you’ll process each month

- average ticket size: how much the average customer will spend on your web site

Who we’ll Compare

There’s an abundance of third-party processors to choose from. In this article, we’re going to compare PayPal Basic, 2CheckOut, and WorldPay against a true merchant account.

The fees for these third party processors are fixed and thus no quote is necessary. As a result, their fees are hard-coded into our calculator. I’ve also listed them here for your reference.

2CheckOut

- Setup Fee: $49

- Discount Rate: 5.50%

- Transaction Fee: 45¢

- Monthly Fee: $0.00

WorldPay

- Setup Fee: $299.00

- Discount Rate: 2.95%

- Transaction Fee: 35¢

- Monthly Fee: $35.00

PayPal Basic

PayPal has different rates, depending on the monthly volume of your transactions. As your monthly volume grows, PayPal rewards you by lowering your rates. There are four tiers available.

- A monthly volume of less than $3,000:

- Setup Fee: $0.00

- Discount Rate: 2.90%

- Transaction Fee: 30¢

- Monthly Fee: $0.00

- A monthly volume of greater than $3,000, but less than $10,000:

- Setup Fee: $0.00

- Discount Rate: 2.50%

- Transaction Fee: 30¢

- Monthly Fee: $0.00

- A monthly volume of greater than $10,000, but less than $100,000:

- Setup Fee: $0.00

- Discount Rate: 2.20%

- Transaction Fee: 30¢

- Monthly Fee: $0.00

- A monthly volume of greater than $100,000:

- Setup Fee: $0.00

- Discount Rate: 1.90%

- Transaction Fee: 30¢

- Monthly Fee: $0.00

Even though PayPal Pro is not being considered in this article, it varies very little from PayPal standard. The only two cost differences are the elimination of the fourth tier for sites processing over $100,000 per month, and the addition of a $20 per month fee. This results in an additional $240 added to PayPal’s total costs after a year.

True merchant account rates vary by provider. Our fictitious company received the following quote for a merchant account and gateway from SitePoint Merchant Services (a fictitious merchant services provider):

- Setup Fee: $0.00

- Discount Rate: 2.20%

- Transaction Fee: 30¢

- Monthly Fee: $10.00

- Gateway Setup Fee: $99.00

- Gateway Monthly Fee: $15.00

These rates are representative of the costs associated with an average true merchant account, and are more than sufficient for our comparison.

To obtain an accurate comparison, we’ll need a representation of the different kinds of merchants that may be using the payment services, as not all merchants will have the same needs. We’re going to compare five different merchants with various ticket sizes and monthly volumes, which have very different process needs.

Mega Merchant: high average ticket and high monthly volume

Average Ticket: $200

Average Number of Transactions: 500

Super Merchant: high average ticket and low monthly volume

Average Ticket: $200

Average Number of Transactions: 5

Bargain Merchant: ;ow average ticket and high monthly volume

Average Ticket: $15

Average Number of Transactions: 600

Mini Merchant: low average ticket and low monthly volume

Average Ticket: $15

Average Number of Transactions: 20

Average Merchant: medium average ticket and medium monthly volume

Average Ticket: $45

Average Number of Transactions: 220

Results of Our Comparison

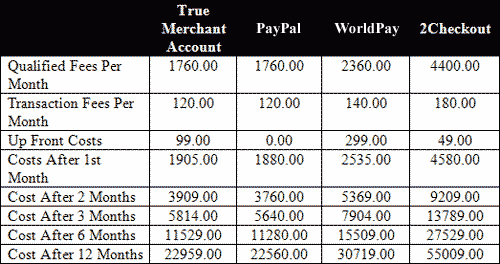

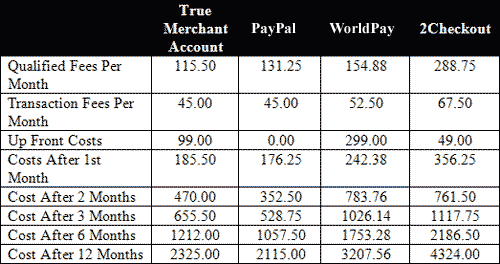

Mega Merchant has a high average ticket price ($200), and also does a high volume of transactions per month (400). The results of our comparison produced the following results:

In this scenario, the true merchant works out to cost substantially less than two of the three third-party processors. PayPal Basic charged less, but only slightly. For a merchant of this size, the true merchant account and gateway would be preferable over PayPal Basic, as the advantages offered by a true merchant account (total control and customization, as discussed earlier in the article) outweigh the cost-savings incurred by PayPal Basic. A merchant of this size is also likely to receive a lower discount rate from a true merchant account provider, further increasing their incentive to choose a true merchant account.

Super Merchant has a high average ticket price ($200), but only fulfills a low number of transactions per month (5). Our comparison produced the following results:

Despite PayPal’s higher fees, it’s clearly the best option for Super Merchant. WorldPay would also be a favorable choice if its setup fee was not so high. Choosing a true merchant account over 2CheckOut provides only a slight saving. The simplicity offered by third party processors (with no gateway to integrate) makes them even more attractive to a merchant of this size.

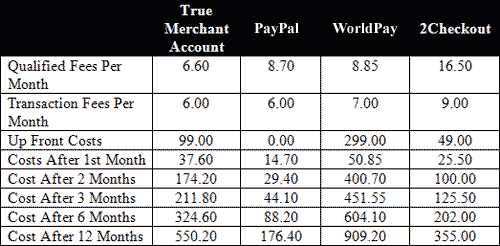

Bargain Merchant has a low average ticket price ($15) but processes a high volume of transactions per month (600). The results of our comparison were as follows:

Despite this merchant’s bargain prices, a substantial volume of transactions are still processed monthly. Here, WorldPay and 2CheckOut are well out of the merchant’s price range, leaving PayPal Basic as the acceptable alternative over a true merchant account. In this case, as with Mega Merchant, the advantages offered by the true merchant account offset the cost savings offered by PayPal Basic.

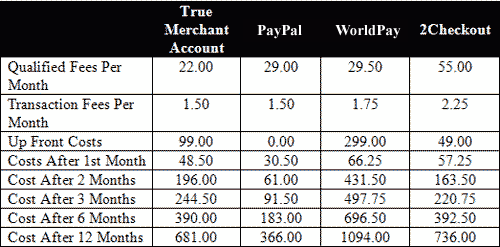

Mini Merchant has a low average ticket price ($15) and processes a low volume of monthly transactions (20). The results of our comparison were as follows:

PayPal Basic is often mentioned as the best choice for a merchant of this size, and the results show why. There’s no question here as to which option best suits the merchant.

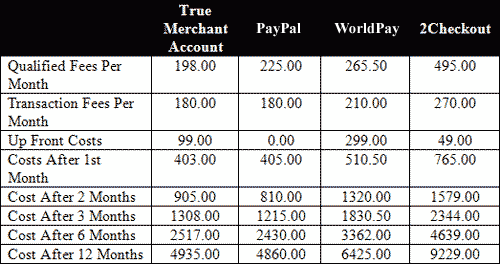

Average Merchant has an average average ticket price, that’s neither high nor low ($45), and processes a moderate amount of transactions per month (200). Our comparison produced the following results:

For Average Merchant, no one company stands out in terms of cost. Our results show that it boils down to a choice between a true merchant account, and PayPal Basic. Average Merchant would almost certainly choose the merchant account, as again, the advantages offered by a true merchant account offset the cost-savings incurred by PayPal Basic. A true merchant account will allow Average Merchant to portray the appearance of a much larger company, and hopefully grow into one.

Conclusion

By now, you should have some idea as to how a true merchant account differs from a third-party processor. While both these methods ultimately allow you to process credit card payments online, the way in which they’re implemented is very different, as are the advantages offered by each.

Something that you should be aware of is the fact that every business is different. Throughout this article, I’ve used a lot of generalizations which may not apply to your business. Be sure to consider all the facets involved with accepting credit cards online, not just the costs involved. Sometimes, paying an additional few dollars a month can mean an enhancement in your customers’ shopping experience, and in the professional appearance of your business.

As with any major decision, take the time to explore all your options. The more research you do, the more likely you’ll be to find a cost-effective solution that best suits your needs.

John works as a web developer for a merchant services provider and is also a partner in a web development company, brainyminds. His latest project, Merchant Account Services, aims to educate businesses about merchant accounts. Visit him online at http://www.johnconde.net.