Every day, we hear of yet another enormous company that’s paid an even more unbelievable sum for an online entity that — it often seems from where you and I are sitting — doesn’t actually generate much of an income. In the last few years, Yahoo! has bought MyBlogLog (for a rumoured $10-12 million), MusicMatch (for $160 million) and Flickr (for an undisclosed value); Google has snapped up Jaiku and MeasureMap for undisclosed sums, and YouTube for the much-touted figure of $1.65 billion.

That’s right: $1.65 billion.

Sums like this may remind some pundits a little too much of the Bad Old Days of the web bubble — some have even questioned big sites’ valuations — but, quite naturally, they lead site owners the world over to ask themselves, “Well, just how much is my site worth?”

Ask in any forum how you should value your web site, and countless would-be online investment experts will give you intriguing, but often contradictory advice. There are the accounting formulae, the professional appraisers, the online tools (just enter a few facts about your site and we’ll give you a rough valuation!), the endless cries of, “if I see value in the site, then it doesn’t matter what anyone else says. I’ll pay whatever’s necessary to get it!” … none of which are very helpful.

So recently, SitePoint set out to find something approaching a clear answer on site valuation. We asked several experts — people who have, for years, made their livings online, and have first-hand experience buying and selling web properties of various types — for their insights into the web property market, and for tips and advice on valuing sites. We also scoured the stats from the SitePoint Marketplace, in an effort to get a more complete, balanced picture of what’s going on at the everyday end of the site sales market.

The ultimate aim of all this was not, of course, to produce yet another formula or tool into which you could plug a few figures and a domain name to get some kind of valuation for your site. Instead, we wanted to clarify the issues surrounding site valuations, and give site owners a clear picture of the factors that were affecting their sites’ values. We wanted also to provide starting points from which you could work to translate those factors into dollar values.

But before we jump into the complexities of site appraisals, let’s shed a little light on the technique that investors have traditionally used to value businesses: financial formulae.

Valuing a Site Using Financial Formulae

Many of us find the valuations given to online entities baffling — the YouTube sale was a case in point. Sure, big companies might pay big bucks, but if Joe Average wants to sell his online forum or ecommerce site, he knows he’s unlikely to sell it to Google. And so, rather than relying on their, apparently generous, valuation, Joe needs a guideline of his own.

Many people in this situation turn to age-old accounting formulae. One common version of these rules of thumb states that the value of an online business lies somewhere between five and seven times its net monthly revenues; another states that the value is around 50% of the business’s turnover.

A quick search online will turn up countless similar rules of thumb. One business broker lists four common methods for business valuation:

- profit-based valuation, which obviously requires the business to have reliable profit figures

- asset-based valuation, which is commonly used by buyers who aren’t really interested in running the business, but want to obtain the assets in question

- the comparable sales method, which considers the sales prices of similar, recently-sold businesses, and makes a comparative valuation on that basis

- the “Rule of Thumb” approach, which compares the industry standard figure for a value that’s considered important (e.g. sales or gross profits) with the business’s own figures. So, for example, you might obtain the average ratio of sales to gross profits for businesses in the industry in question, then compare it to the same ratio for the single business in question. Ultimately, this compares the business to its industry average, but is used in specific industries.

Rob May, owner of ValueOnTheWeb.com (2022 Update: No longer running), a company that developed and sells a web site valuation system that allows customers to tap into a raft of web property market data in order to gain insight into their own sites’ values, makes an important distinction between these formulae, suggesting that “what really matters is cashflow and net profit.” In this vein we find another rule of thumb that’s long been used to assess the value of an investment: the “discounted cashflow approach”, where the projected income from the site over a given time period is discounted by the rate of interest you want to earn on your money within that time period. This approach is used to determine what you should pay for that investment now — in today’s dollars.

This sounds good, but can cashflow- and profit-based formulae like this really be relied upon in the volatile online market? Rob doesn’t believe so. He contends that, “when it comes to web sites, those values can vary dramatically from owner to owner because the cost structure can change with a new owner. For instance, if a site has both programming and content work to be done, I’ll outsource the programming, but might sometimes write the content. Another owner may outsource the content and do the programming. Another owner may outsource both.”

So although a formula might give a buyer a valuation of the site as it stands, from a purely financial viewpoint, it can’t take into account the value a new owner might be able to add — that takes foresight, vision, and a thorough assessment of the skills and capabilities that the potential buyer can bring to the table. And that’s probably why, though there are numerous valuation techniques, many pundits advise site owners to ignore all such rules, or at the very least, to consider them as only one piece of a much larger jigsaw.

Yet Dan Grossman, of Awio.com — a network of sites that provides tools and information for site owners — believes that there are some cases in which a formula might be worth considering as one aspect of a valuation. “If you’re going to buy a web site just to continue operating it, then basing the buying price on expected future revenues is fair,” he comments. But again, he points out that “it’s not always that simple. When I browse the SitePoint Marketplace and other similar venues, I’m looking for two things: a web site with great content or technology that could grow significantly if it were exposed to the right market, or one that would integrate well with my existing sites to grow their revenue. The price of that kind of purchase isn’t strictly based on the revenue the site is currently earning, but what value it can potentially bring.”

That sentiment is echoed by Chris Beasley, web publishing stalwart and Editor of websitepublisher.net. “As a buyer what matters is what a website is worth to you,” he comments. “If think you can make 10 times more than what the current owner makes, then limiting yourself to a multiple based on the current owner’s revenue is dumb.”

These comments hint at the miasma of factors that can impact on a site’s ultimate sale price — factors we’ll get to in a moment. But in addition to the nuances of the site itself, there are two broader considerations that a formula simply cannot take into account. Yaro Starak, an online businessman who tracks his adventures online at Entrepreneur’s Journey, identifies one of these considerations. “As with all investments, what someone is willing to spend is what something is worth,” he says. “As long as we’re dealing with people, the potential to manipulate price is very real.”

What we might call the “human factor” obviously varies with each sale, and each of the parties involved — there’s no accounting for either gullibility or ruthlessness!

Of course, in the changing world of the Web, site sellers need to beware of more than just intentional manipulation. “The Internet is fast moving and situations can change very quickly if a new site comes to the market in your niche,” advises PrimitiveNetwork’s Tim Dickinson. “Paying more than the predicted profit for the next year or two can be risky, and even if a site offers more than just profit to you or your users, you still normally need to break even on a site at worst.”

Again, no formula could have anticipated the explosive popularity of social networking sites — that kind of foresight requires more than an ability to crunch numbers.

It seems that, while a formula may provide site owners with a starting point, the limits of a formula-based approach may greatly restrict its relevance to many of the deals being made today. So, if formulae and accounting equations only give us a part of the picture — at best — what else should we consider in valuing our sites?

Site Value Factors

There are nearly as many factors that are seen to contribute to a site’s value as there are people who have bought or sold web properties. Among the lists of factors that can impact on a site’s value are:

- the nature of the online property (for example, blog, informational content site, social network, online community etc.)

- the age of the property and its domain

- the perceived value of the brand, and goodwill associated with it

- the profits or earnings generated by the property, and the revenue model through which they’re earned

- the projected life of the site and its niche

- the amount of traffic the site receives, and where that traffic comes from

- the site’s SEO strategy, and its PageRank

- the number and quality of backlinks to the property

- the costs of running the site, including promotional costs, time costs, and so on

- the risk involved in purchase — a factor that may depend equally on the buyers’ perception as it does on available critical “wisdom” or research regarding the market segment in which the site operates

- the property’s or business’s position within the market, its uniqueness, and the levels and types of competition it faces

- the comparative cost to the buyer of developing the site themselves

- the barriers to entry to the market that the potential buyer would face if they were to enter the market themselves, building a separate business from the ground up

- the number and value of perceived opportunities available to the site

- the property’s strategic fit within the potential buyer’s operations

- the property’s appropriateness to the potential buyer’s skillset

- the ease with which that buyer can monetize the site further, including the expense of any changes the buyer might like to make to the site after its acquisition

Yes — that’s a stack of considerations, and working out the value of each in reference to your own site will be quite a task. Moreover, this list is far from all-encompassing: different factors may affect different sites’ valuations at various times throughout its life.

If you’re beginning to think that site valuation is an incredibly complex task, you’re right. Fortunately, our experts were keen to wade through the list and identify the factors that they felt had the greatest importance in a site’s valuation.

The Top 3 Value Factors

1. Domains and Traffic

Of all the factors, advises Andrew Johnson, owner of the popular webpublishingblog.com, “domain name value is number one. It only applies to a few, but …if your site is sitting on a generic domain name, the amount of money the content side throws off may have no bearing on its sales price.”

Yaro focuses particularly on “traffic growth over the long term (sustainability), sources of traffic (do you have to pay for it to keep it coming, or is it organic?) and revenues.” And he believes that site buyers are keen to know “how much revenue a site makes, how much profit there is after expenses, how much traffic it gets today.” He suggests that they’ll want to see “a month by month history of traffic, and if possible, a breakdown of each traffic and income source.” Tim backs this position, contending that “traffic demographics are all-important. For instance, advertisers tend to pay more for visitors from western nations, and for users with relatively high disposable incomes.” This point may be especially pertinent if, like Tim, a potential buyer of your site believes that “ad targeting is the name of the game.”

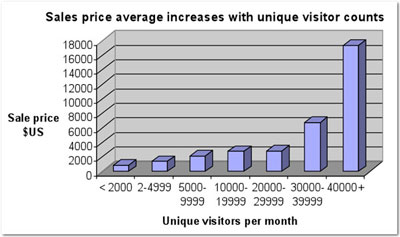

These arguments are reflected in site sales from the Marketplace. There, sites that receive fewer than 2000 unique visitors per month (a total of 477 sites sold) sold for an average of US$906 — significantly below the total average sale price of US$1560. By contrast, of the 89 sites that sold which attracted between 20,000 and 30,000 uniques per month, the average price was US$2843. And sites with more than 40,000 unique visitors each month — all 27 of them — averaged a sale price of US$17,401, though the highest selling price in that category was US$185,000. Here’s the complete breakdown.

As you’d expect, the sales price breakdown was similar when pageviews per month were considered. Sites that attracted fewer than 1000 pageviews a month — including those who didn’t’ provide pageview figures — sold for an average of US$903, and those with four-figure monthly pageview counts didn’t fare much better — US$959, on average. At the other end of the spectrum, sites clocking up hundreds of thousands of pageviews each month sold for an average of US$5563 — though there were only 289 of them, and the average sale price for the 13 sites that totalled 10 million or more pageviews per month was US$20,186.

Can you produce traffic figures and a demographic breakdown of visitors to your site? If so, you’ll be in a better position than other site owners in your niche. Yaro predicts that the importance of traffic will continue to grow in future sales. “I expect more and more large companies are going to go the rout of buying sites as a means to acquire new traffic sources rather than, or in addition to, all the traditional ways to build traffic online, like SEO, PPC and content creation.” Chris also supports this argument, albeit more broadly…

2. Stability and Profits

“What I’m concerned with are assets and net profit,” Chris says. “Assets would be things like domains, software, intellectual property, and even link weight.” If you think Chris prefers older sites to turnkey ventures, you’re right. “One of the more important factors for me is stability and age. I would characterize an “established” site as being three years old or older,” he reveals. “Stability of income is an unsung hero of web site publishing.”

It’s certainly true that of the sites for sale a disproportionate amount are recent developments. Of the sites sold in the SitePoint Marketplace, more than 85% were less than two years old. In Chris’s three-year-plus category, we find just 110 sites, or just over 5% of the total sites sold. Obviously such sites are rare, which buyers would expect to translate to a premium price.

Tim reveals one outstanding benefit of stability. “Advertisers tend to feel safer with recognised web sites and established brands,” he says, “so web sites that are recognised and well established in their niche can be worth more, as they could earn greater profits for the same amount of upkeep.”

But stability can boost profitability in more ways than one, as Rob points out. “Sites that require less work, like well-established forums or article directories, command a higher premium,” he says, “because buyers want to make as much money as possible with as little work as possible. And as Tim suggests, “web sites that have to attract new customers from search engines are risky investments, because your customer acquisition costs can fluctuate dramatically over time.”

Andrew summarises that, “in terms of long-term value, you want a site that has a diversified range of traffic sources that will not disappear over night,” and Rob agrees. “In general, I think PageRank is worth less,” he says. “Steady organic traffic is worth more, and stable monthly revenue matters a lot.” He points out, of course, that the balance between these factors varies with the type of site and its revenue model. But the factors apply across the board, to some degree.

Though Andrew feels that PR isn’t as important as other factors, it’s interesting to note that there was some correlation between PageRank and sales prices in the SitePoint Marketplace. Sites that listed a PR of zero sold for an average of US$459 — and there were nearly 300 of them. The 144 sites with a PR of 2 averaged a US$1145 sale price, while sites with a PR of 6 averaged US$12,061 (over 47 sales). Though other factors are inherent in every sale, the statistics do suggest that, if PR doesn’t directly impact a site’s sale price, sites that sell for larger sums tend to have better PageRank. And despite the opinions of our experts, in the site selling market, it’s likely that PR still has a role to play in a site’s valuation.

3. Potential

“Has the site owner pushed the site to its maximum income potential?” asks Andrew, highlighting a consideration that many site owners tout as the justification for what often turns out to be an unjustifiable site price tag: that a site has great potential. “In some cases,” Andrew explains, “30 minutes of work can double a site’s income. That’s extreme, but it is reality.”

Tim firmly agrees that potential impacts on value. “A site may be worth a purchase price — even if it will make a financial loss itself — if it has additional value to you in userbase targeting or spin-off sales from technology.” Yaro takes a similar view. “If you can plug a traffic stream straight into your business and make a return, then it doesn’t matter if the site makes no money by itself,” he says, adding that this reduces the site’s value to other buyers, “meaning you can get a bargain.”

“A site buyer needs to evaluate a site as if they already owned it,” Chris says, “under the concept of “What could I do with this?” rather than only worrying about what the existing owner did with it.”

“If it’s going to increase your revenue,” Dan summarises, “then a web site definitely has value, regardless of its current income.”

Getting to know your buyer might give you an opportunity to present them with possibilities for the site’s future development — to illuminate new directions with solid revenue potential. “As a seller,” Andrew advises, “I think it is completely fair to reprice your site based on who the interested party is that is buying.”

Other Value Factors

Workload

For Andrew, workload is another important determinant of site value. “Does the site require a lot of man hours to run?” he asks.

“Often I’ll see sites that score well in terms of domain value, traffic, and potential, but require a great deal of day-to-day work on the owner’s part. If you have a team working for you, or can profitably hire someone, this isn’t such a big deal. But the truth is, if you just let the site sit, its traffic and earnings are going to erode (something to consider if you’re buying to hold rather than buying to sell).”

Yaro concludes that the best buys often are those that “run off models that don’t require much ongoing work or investment from the owner.” This is a big consideration for those looking to sell high-maintenance sites: the more you can automate processes, the greater the potential for a higher sales price.

The listings in the SitePoint Marketplace reveal the importance of workload to buyers. “Attain steady income with this easy-to-earn web site” invites one seller whose property — a movie download review site — sold the next day. Another seller promotes his offering with the words “No work — easy AdSense Revenue”, while another invites buyers to “Let the site do the work for you”. Yet another site offers a script that crawls other sites, with permission, and feeds content back to the main site — definitely a low-maintenance affair. Just 24 hours after the site was listed in the Marketplace, it was sold. This small sample suggests that low maintenance is a big selling point!

Synergy

“What does the buyer bring to the table?” Andrew asks. “If you study corporate acquisitions, the ones that work out are when they are closely related to the acquiring company. This is what is called “adjacent spaces.” If you already run a site in your potential acquisition’s niche you may have additional market knowledge and assets others do not.”

Obviously, synergy has a close tie with — and huge impact on — a site’s potential to any one buyer. And the degree of synergy will vary with each different seller who investigates the site for sale.

So what exactly does Andrew mean when he talks about the assets one buyer may bring to the table that others cannot? The answer to this question takes in many factors. “Market knowledge could be a better understanding of how to structure a site to make it more profitable; assets could be a relationship with a deep pocketed advertiser. These are things that bring leverage to an acquisition.”

Rob makes the point that in valuing a site, the seller has “to consider whether it’s a financial acquisition or a strategic acquisition. The latter usually gets a higher price” — a point that sellers should keep in mind as they prepare — and price — a site for sale. By looking at the potential buyer’s other operations and possible plans for your site, you can get a clearer idea of your site’s value to them.

Technology

Tim points to a potential burden inherent in a site’s sale, saying “the technology behind the site and your license of it is also very important. If the site’s using a commercial script then you’d have to continue to pay license fees to run the site. If the site uses well-known open source scripts then it must do more to stand out from the crowd. If the site uses a proprietary script, then is it well made, do you have exclusive rights to it and what warranty do you get with it?”

If you can answer these questions about your site and, more importantly, ensure they don’t present hurdles to potential buyers, then you may be able to command a better price for your site.

Of course, technological considerations aren’t all bad news, as Tim is quick to explain. “If the proprietary script is of a high quality and sold exclusively with the site then there could be monetary value in licensing the script to other sites, or even making it open source so the development costs will not rest solely with you,” he suggests. Astute buyers may well review these kinds of possibilities in assessing a sale, so be prepared to answer technical and licensing questions about your site.

It’s interesting to look through the sales of technology — scripts, script sites, and so on — through the SitePoint Marketplace. PHP-based sites and scripts seem popular, (one sold for $2200 in 7 days, another for $3000 in 3 days) as do sites that use standard, well-known technologies such as WordPress and VBulletin.

Comparative Cost

We mentioned comparative cost analysis as a formula for estimating site value, and in fact Dan Grossman says that he uses this analysis as a starting point for a site evaluation. “To get a baseline, I consider what it would cost to replicate the site,” he says. “If it’s got lots of original content, or a complex service, the answer is probably ‘a lot.'”

Dan believes that this kind of assessment can help potential buyers find bargains, as valuable sites are sold for a figure below the real cost of creation. “A lot of times this happens when there’s an individual owner or creator who doesn’t factor their years of labor into the price,” he reveals. “For instance, they may only use the basic revenue multiplier to value the site.”

Chris agrees that comparative cost is an important factor in assessing a site’s worth, but from a perspective of establishment rather than development. “New sites can often simply be imitated rather than bought,” he says. “Sites can be built to function identically to other existing sites, and content can be written that covers the same topics, so all existing sites have is their built up traffic, customers, and link weight.” As Chris points out, these are the aspects that take time to establish, and that give a site “a perpetual head-start against any other competitors.”

In evaluating these factors for a site, Chris looks at the costs not just of replicating the site, but also, the investment and time required to “promote it to the point where it’s doing as well as the one you want to purchase. If the sum you come up with is less than the purchase price, that tells you something.”

Sellers must be wary of undervaluing their time. Experienced buyers will expect to pay for the time that’s been spent both developing a site and establishing its position within a niche. If a buyer baulks at a price that takes this time into account, you can always present them with a comparative cost analysis that shows exactly how much it would cost them to create and establish the same site from scratch. Of course, if potential buyers can design and build a similar site for less than the asking price on a turnkey proposition — and they have an equally useful domain, and other assets — then they’re likely to have difficulty seeing the value in the sale.

The Value Factors At Work

Given these indications of what buyers are looking for, you’re probably getting an idea of the rough price range in which the value of your site might fall — toward the higher, lower, or middle areas of the price range. But there’s one key element that we haven’t considered yet, and that’s the type of site you’re selling. If we were to compare the web property market with the physical real estate market, a site’s type might be comparable to the neighbourhood in which a house was located. And as we all know, that has a big impact on a property’s value.

To get an idea of the ways in which the different value factors impact on sites of different types, we asked each of our experts to comment on how they would value a particular type of site.

Valuing a Content Site

Chris Beasley gives us two critical questions he’d ask himself if he were assessing a content site for sale: “What is the site worth to me? How much can I make off the site?” They seem simple enough, but as usual, the answers depend on a number of factors.

“If I have some exceptional synergy such as a related ecommerce business — and so I could gain both link weight and direct customers from cross-promotion — then I would likely pay a good deal for such a site,” Chris explains.

A content site’s value may be a factor of the site’s synergy with the potential buyer’s current operations, but does this mean a valuation of a content site will always be heavily subjective? Not if the site’s being acquired for financial, rather than purely strategic, reasons.

“If I have no synergy with the site for sale,” explains Chris, “then I’d have to base the assessment off current income, or what I believe the current income could be if I controlled the site, minus the cost of the time spent bringing the site from its current state to what I’d see as its “optimal” state.”

In valuing content sites for financial acquisition, Dan uses a mixed approach. After his comparative cost analysis, he says, “there are a couple key metrics that help you come up with a reasonable value.” He considers “whether the content is original, what level of traffic the site receives from search engines and natural linking, and how long you expect that traffic to continue.”

The nature of the content obviously has a role to play. “Some content lasts, while other content doesn’t, and lasting content that remains relevant for years can be more valuable in the long run,” Dan says. Chris agrees that quality content holds value: “If your content is poor, the buyer could likely easily replicate it for less than they’d pay you.” However, he believes the importance of quality content can decrease with increasing site stability. “As a site grows older, more popular, and more established, then the need for original content gets smaller and smaller. If your site brings in 10 million page views per day, no one’s going to care if the content is unoriginal or not unique, so long as it’s legal,” he says.

Dan believes that ease of monetisation of the site is another key consideration. “If the site’s traffic is already being monetized, I look at whether I can see ways to monetize it better, which might make it worth more than current revenues.”

Content site owners will need to consider the nature of the potential — or most likely — buyers of their sites in valuing those sites. Obviously, the reason for acquisition can impact on the relative importance of the value factors, and as a content site seller, you’ll want to consider both strategic and financial acquisition types if you’re going to get a fair price for your site.

Valuing a Blog Site

“Blogs are tricky to evaluate,” Yaro Starak warns sellers of sites in this blossoming genre. “The value really depends how entrenched the audience is with the current writer or writers, and if you were to buy the site, whether the current writers are coming along with the sale too.”

For most blogs that are run single-handedly, the answer to Yaro’s second question would be a resounding “no!”, but does that mean a one-person blog has no value? Absolutely not. “Some blogs have a brand with no specific personality attached it,” Yaro continues, “in which case it’s easier to assess the worth of the site using the standard metrics we mentioned above.”

Of course, blogs that are driven heavily by the author’s personality — like Yaro’s own site — are a different case altogether. “If the site is driven off the back of one or several particular writers,” he says, “unless you can retain them or bring in people of equal talent, you risk losing a chunk of the audience with the change of ownership.”

That’s a big risk factor for anyone buying into this shifting market — it seems likely that the more unique and personalised the blog content, the greater its potential for success — and the more difficult it may be to sell if the writer doesn’t come with the site. So are blogs a catch-22? Not if the writing team is part of the deal, or if the value of the site lies in the nature of the blog content, or topics covered, rather than the personalities and writing styles of individuals who work on it.

There are other potential pitfalls for the would-be blog seller, though, the most prominent being the workload involved. “Blogs require a constant flow of content to keep traffic and revenues growing,” Yaro warns. “If you have good writers available it’s not an issue, but if you don’t, there are better web sites you could buy that run off models that don’t require as much ongoing work or investment from the owner.”

Rob agrees that the amount of work involved in running a blog may also be affecting this segment of the web property market at the moment. “According to our data,” he says, “blogs have sold on average for about 11.56 times revenue over the last year. Sites with more static content have sold for an average of 14.37 times revenue. They attract a price that represents a higher multiple of revenue because they’re less work. But, if you look at the graphs, blogs are easier to get to higher monthly revenue figures than static content sites.”

Bloggers wishing to sell for the highest price would do well to automate their operations as much as possible, focusing on developing the revenue potential of the site and preparing it as best they can for easy monetization. It’s also important to pursue a business strategy that relies on good, focused content, rather that enticing personalities.

Valuing a Community Forum Site

Tim Dickinson believes that, as with any site, the value of a community forum relates to both synergies with the potential buyer’s operations, and the revenue strategy that has — or could be — implemented on the community site.

Now on a forum site, members mean revenue. And revenue, more often than not, is generated through advertising. Are particular community sites better bets for ad revenue generation than others? Yes, says Tim. “Some niches will be of greater value to an advertiser as the relevant products could be of higher value, or the demographic of the users are more wealthy people with spare cash to spend,” he advises.

User experience within the niche or industry on which the forum is focused is also closely tied to a site’s ad revenue potential. Tim believes a mix of expert (innovator) and less-experienced users offer the greatest potential, as “advertisers on the forum gain from being associated with a site that offers honest and high-quality discussion, but also from getting ‘eyeballs’ from casual users who have come to the forum.” To that end, members’ profiles are an asset that can boost a forum’s sale price. “Better member profiles generally mean more information,” Tim explains, “which can be used to target ads more effectively.”

“The number of visitors is another factor that’s of central importance to the revenue potential of a site,” says Tim. This is not to say that smaller niche site can’t do well, but that it’s potentially easier to make money with a larger community. Smaller sites must overcome a couple of extra hurdles if they are to achieve high sale prices. One is the potential impact of losing key staff members as a result of the sale — a situation that Tim believes larger sites would be in a better position to weather. Another is the perception that, as Tim says, “forums need a certain number of visitors to keep all the content fresh and questions answered quickly.”

Regardless of a forum’s size, activity is always considered in a sale. Often we’ll see a sale listing for a community site whose owner boasts, “I could make $x a month quickly, if I only had the time to monetise the site,” though the site languishes with few posts and even fewer members. Tim doesn’t really see value in this kind of purchase. “If a forum hasn’t reached critical mass,” he argues, “it has little more potential than a brand new forum with few users other than the content that is on there. Forums that haven’t reached critical mass should be treated exactly as a pure content site in terms of value.”

Does this mean sellers of large, established forums are necessarily on easy street? Not quite! “The site would certainly have potential,” Tim says, “but the new owners would have to be very careful about how they treat the users once the transaction is complete. The selling of a community can often lose users, as people feel slightly betrayed by the old owners.”

Transition strategies — where the new owners are introduced to the forum and co-run the community with the seller for a period of time — might help overcome this hurdle. And of course, a well-planned transition strategy could also translate to an improved selling price for the site.

Valuing a Site that Sells Products

Sites that sell products — traditional ecommerce sites — can seem comparatively easy to value. But are they? Tim believes that “Web sites that sell physical products should be valued in the same way as highstreet retailers — by the volume of products they sell and the profit they make from each sale compared with the cost of making or obtaining, storing, and sending the goods to the buyers.” Ultimately, he argues, a financial basis for the assessment is just. “The site should be valued on the amount of net profit it makes after all costs, and there are more costs involved with ecommerce sites than with content or community sites because of all the physical product handling tasks.”

Of course, provided the finances look good, other factors will also come into play. Dan lists numerous questions that potential buyers will likely be asking themselves:

- Do you have to maintain inventory and a warehouse to store it in?

- Does the purchase come with any existing inventory?

- Who supplies the products and at what cost? What are the payment terms? Are there any fees to becoming a distributor?

- How are orders fulfilled? If it’s done in-house, how many employees does it take? If it’s outsourced, how much will it cost to continue outsourcing fulfilment?

- What is the return rate for products the site sells?

- What is the chargeback and fraud rate for the site?

- Will the previous owner be around to help in the transition?

Pre-empting these questions — and providing helpful solutions to any issues the buyer perceives — may put the seller in a good position to get a great price for their site. Obviously, the buyer’s previous experience with both ecommerce and the niche in which the site operates will have an impact on how much help they desire, but the seller would do well to anticipate and respond helpfully to any concerns the buyer might have about the business’s operations.

The products that the site sells — and the markets it serves — are obviously crucial considerations for any buyer. “If a site is selling something like books,” says Tim, “it has to compete with the big boys of Amazon, B&N, Waterstones, and others. It has to do something better — or generally be cheaper — than them to compete. Focusing on a niche could separate the business from the pack, but the site would have to show expertise in that field, perhaps by offering content on the site as well, or offering a wider selection of books from that niche than the other retailers.”

Next up, says Dan, “you have to figure out the value of the current customer base” — a job which he describes as being “part research and part intuition. The existing owner should be able to tell you about the number of orders per customer and the percentage of new customers that become repeat customers,” he explains. A buyer may also want to see customer records or profiles, complaint registers and resolution strategies, and more. They’ll likely be interested in the way customers have been treated in the past, as well as the approaches the seller has taken to building loyalty and new customer acquisition, and the costs involved in those approaches.

But from that point, valuing the customer base becomes more difficult. “Potential buyers have to take a look at the products and customers and get a feel for whether they’re likely to keep buying after a change in ownership,” he says. And, similarly to the business’s staff, its customers can react to new owners. “Sometimes, the web site is run in such a way that the customers are very attached to the current owner,” Dan says — a point that site sellers will want to factor into their valuation of the site, as it increases the buyer’s risk. “Other times, the change in ownership can happen behind the scenes.” Obviously, from the buyer’s viewpoint, this will likely be the best scenario, so it might pay the seller to develop the business with a view to their own exit from it.

Synergy also has a role to play in an ecommerce site valuation, says Tim. “As with purchasing other sites, if the buyer already has a network of web sites devoted to a subject, such as gadgets, then a gadget-focused ecommerce site would be worth more to them than an ecommerce site in a new field.” As well as the potential for greater monetisation, this arrangement would let the buyers leverage their existing expertise in the field. Tim believes those skills “could be used to help the site expand, so growth may be easier and cheaper to achieve.”

“Finally, the relationship the web site or company has with its suppliers and staff is also important,” Tim adds. In fact, it’s critical, he feels, in making sure “costs won’t rise significantly after someone new purchases the business.” If staff relations are poor, or staff feel that they are mere pawns in the sale of the business, this could ultimately affect the sale price. Of course, if the business is a one-person affair, then the buyer may want to assess the tasks involved in order to plan their growth of the business, and potential staff acquisition. The seller who makes such planning easy, by providing details and assistance as required, will likely end up with a better sale price.

Valuing a Site that Sells a Service

The number of these types of sites — those that sell image or video hosting, spam protection, and so on — is continuing to grow as the acceptance and perceived need for innovative, intangible services escalates. And the prices — in the big sales at least — seem to be exploding too. Does this mean valuing such sites is more complex than others? Andrew Johnson doesn’t think so.

“I would look at their traffic source first. Is it sustainable?” he asks. While it sounds elementary, this is an important point — particularly for sites in a newer genre than some others. “The traffic could come from word of mouth,” Andrew suggests, “which leaves lots of room for growth in advertising and free organic search traffic. However, if the bulk of those profits are coming from less than stable sources, it may be worth a bit of a discount.”

“Just as importantly,” Andrew continues, “how much time does the new owner have to put in? Are you buying yourself a job? If the seller is currently doing all the work, can the buyer still outsource it profitably?” This issue often crops up in the sale of more innovative sites that, as brain-children of their owners, demand a lot of care and feeding. If your site requires much of your time, perhaps you should consider ways to automate aspects of it before you sell, as a means to add value and gain a higher sales price. After all, as Dan Grossman is quick to add, “With a subscription or product site, it’s more about revenue and the costs of running that business.” Reduce those costs, and your sales price will likely increase.

Of course, innovation frequently justifies a higher price. “If the service is truly revolutionary or a market leader you could likely add a premium to its value,” Andrew comments, indicating that a little research, a comparative cost analysis, and taking any opportunity to clearly differentiate your site from others, could pay off in your negotiations with potential buyers.

With this, Dan firmly agrees, but as well as the uniqueness of the technology, and how easily it could be replicated, he believes that “you also have to look at whether it will it scale as growth continues, and will the buyer be able to maintain it without the original author’s help? There’s also a loyalty issue there,” Dan suggests, arguing that steady sales could drop after a change in ownership, particularly on sites that offer scripts, software, or tools, and for which responding directly to the customer community — with correspondence as well as product enhancements — is critical to success.

Good — or bad — news for owners of sites that sell intangible products and services is that the buyer can have a significant impact on the potential selling price for an innovative site. As Andrew is quick to point out, “Rupert Murdoch was laughed at for paying $600 million for Myspace. After a $1 billion ad deal with Google he looked like a genius.” And although, as Andrew says, these kinds of numbers defy logic for those looking at value investments, they do make the unique service site segment seem extremely lucrative for the innovators out there.

That said, sellers must recognise the risks buyers take in making such purchases. “Technology is evolving very, very rapidly,” Andrew summarises. “It can work both ways — perhaps in 5 years your company is worth $1 billion, or your entire business model might be extinct.” Dan agrees. “Many service industries are expanding right now, so it’s important to consider the direction in which the market for that service is moving. If it’s growing, and the site provides some unique value to that market, it may be worth significantly more than current revenue.”

Ultimately, risk is inherent in these types of purchases, but the market direction and technology might be the biggest issues the site buyer faces. Site owners looking to get the best price for their service site need to make sure that the site was built with a vision for the future, that they can identify potential directions for the site and service it offers, and, of course, that the technology is robust and scalable. Verifying traffic sources and reliability, and ensuring the site has a minimal maintenance burden should also be goals for the would-be seller wanting to get the best price for their site.

Using Site Appraisal Tools and Services

Many site owners feel that they’re the best judges of their sites’ worth — and their predictions are horribly wrong. Perhaps their research is poor, or their perceptions of the sites’ potential or revenue potential are off (after all, it’s hard to be objective about a site you’ve put your life into). Either way, self-assessment can end in tears.

As a result of the general uncertainty and perceived unpredictability of the online property market, numerous tools and appraisal services have emerged to cater to the needs of site owners who want an objective view of a site’s value.

The tools, including dnScoop and Tidget.com’s Tidgulator, tend to assess a site on the basis of a number of tangible factors — traffic, PageRank, backlinks, the number of years the site has been online, how long the domain has been registered, the value of property that will be transferred to the new owner, and so on — which may or may not necessarily have relevance to your site’s sale. The other potential hitch with these calculator-style tools is that they rely on your own perceptions much of the time (for instance, in valuing the property that’s involved in the sale), which can lead to unrealistic expectations. That said, these tools can alert sellers to many of the factors they might consider in assessing their sites’ worth, and the tools can also be more affordable than appraisals — the sites provided here provide value assessments free.

The appraisal services, of which buysellwebsite.com and Venture Planning Associates are just a couple, typically promote their offerings as providing a value-add for the seller that can increase the ultimate sale price. They account for a wide range of less tangible elements like the site’s stability, ease of use, content offering, and potential sources of income, as well as the nuts-and-bolts metrics of unique visitors, pageviews, and so on, but this investigation comes at a price — from around US$450 up.

The options can be bewildering — particularly for first-time site sellers, or sellers operating in a segment of the property market that’s new to them. So are these offerings worthwhile?

Tim is quick to outline his concerns. “The tools use a straight formula. This is fine, but they aren’t people and they don’t check the originality or quality of the content or design, which are both very important.” Chris furthers this argument, saying “any type of objective algorithmic evaluation will always be second rate because statistics are in the end only a portion of what gives a site value.” And Dan believes that “only being diligent in your own research will tell you if the traffic and links the site attracts are transient or likely to stay, if the users will remain loyal after an acquisition, and if there’s a growing market for whatever content or service the site offers.”

Rob sees another problem with assessment tools, commenting that “I used to use them, but most of them are way off. They give site owners a high price, because that makes the site owner feel good, and come back to use their tool again. But then the sellers get mad when no one will buy at the “appraised” price”

But Yaro sees a role for these kinds of offerings. “I don’t use tools that attempt to tell me a site’s worth,” he says, “however, I do use tools that give me data related to how much a site is worth.” He uses tools like the SEOMoz Pagestrength tool, Yahoo Site Explorer, the Search Status extension for FireFox, and the Way Back Machine to obtain vital statistics on a site — AlexaRank and PageRank, how long it’s been online, the domain name’s age, the number of pages it has, and backlink counts from authority sites. He uses all these factors to build a clear picture of a site, but then relies on his own assessment, including “just spending some time at the site I’m evaluating,” to develop a solid idea of the site’s value.

Chris also has faith in what we might call the “human factor”. “The best tool in my opinion is a panel of experts, AKA a forum, who can give you a human opinion.” So does that mean he advocates the use of appraisal services? “No,” he says. “I’ve never seen a professional site appraisal service that gave what I thought were realistic appraisals.” Dan is more open to the idea. “Appraisal services with real people behind them can be valuable,” he suggests. “Unfortunately a lot of business appraisal services are geared toward the offline world, focusing on accounting and physical assets.”

Another potential hurdle facing those who might otherwise consider using appraisal services is cost. “For smaller purchases, the costs of hiring these people can be more than the value of the site, or certainly take a large chunk out of the first year’s potential profits,” says Tim. For bigger sites, though, he sees the value of professional appraisal. “If a site costs millions to run, or claims to make millions in profit, then a professional site appraiser can help the buyer to decide with more peace of mind if the site is worth the purchase price.”

Of course, as the market matures, these services may have a bigger role to play. “I expect as the industry expands, more and more people will come to use professional appraisal services as part of the process to assess any potential purchase,” Yaro predicts. “One or two services that offer exceptional output and have a demonstrated history and knowledge of the industry could rise to the top and become must-use services for any serious web site traders,” he adds.

It seems that, for now, the value of appraisal tools and professional services may be very limited for smaller site sellers — and the argument that an appraised site will sell for more may be difficult to substantiate. After all, as Chris says, the decision to sell a site ultimately comes down to opportunity cost: “what is the opportunity cost of not having the money from the sale in your pocket?” Again, the human factor can do much to undermine theory and statistically based assessments.

What’s Your Site Worth?

Ultimately, in identifying the value for your own site, you’ll need to research the site sales market — in particular, your market segment. You could start your assessment using the free tools we outlined above, using proprietary statistics packages like valueontheweb.com, which is owned by Rob May, who we interviewed for this article, and researching sales of similar sites at places like the SitePoint Marketplace, and through the technology media.

As you research, make notes of the factors that seem to be influencing sales in your sites’ segment of the market, as well as the high- and low-end sales prices achieved. Alongside those records, include information pertaining to specific sales and factors that impacted on those prices. Perhaps a site similar to yours achieved a very high price because of the existing revenue streams and the potential for future monetization that was provided by detailed member profile data. Maybe a site that sold for a seemingly low price lacked the history and proven traffic stability of your operation.

Next, it’s time to scrutinise your own site, being as objective as possible. First up, complete a SWOT analysis of the site’s strengths, weaknesses, opportunities, and threats. Review the list of value factors that can affect a site’s sale price, which we discussed earlier, and try to predict how each factor that’s relevant to your sale might affect the buyer, and thereby, the sales price — this will be easier in some cases than others. Pay particular attention to the advice of our experts, who indicated that the most important factors in determining a site’s value were:

- Domains and Traffic — Consider the age of your domain and the sustainability and reliability of your sources of traffic. Is your site one of the oldest in its segment? How do your traffic levels vary, and why?

- Collate documentation of traffic levels and proof of domain registration.

- Stability and Profits — Can you provide long-term records of your site’s profitability and a breakdown of costs, revenues, and so on?

- Collate financial documentation, receipts of payments, lists of creditors and moneys paid and owed.

- Potential — Determining potential can be difficult, but if you can see scenarios in which your site could be developed to greater effect, it could be worth your while to list these ideas in your site sales listing (if you’re selling it through a marketplace). When you’re determining potential, consider also the costs involved in reworking the site to achieve that goal, as these will be considered by any prospective buyer.

- Make a list of the directions in which the site could be taken, and outline how difficult or easy these transformations would be.

- Workload — as well as considering the work a buyer would need to do to rework the site to achieve its potential, assess the level of work that’s needed to maintain the site at its current standard. Factor in your time, as well as that of any other people who work on the site.

- Itemise the tasks involved in running the site, and against each, place an estimate of the total time involved. Costing the time might also be worthwhile, as a potential buyer can then tell, at a glance, how much they might be able to save on operational costs if their setup allows them to use existing resources for certain jobs.

- Synergy — consider the business types alongside which your site might sit well. This information might help you to target potential buyers through an online ad or marketplace listing.

- Technology — review the technology that underlies your site, as well as that involved in any property that will be transferred with the sale (eg. scripts, software products, and so on). Assess the costs of technology, its reliability and robustness, and its scalability as the site grows.

- Collate records of the costs of the site’s hosting, licensing costs for technology, and so on. Though these costs will likely be included in your financials, outline them here, too, to make it easy for buyers to access this information. It might also be wise to ask the developer (who may be you!) to provide an assessment of the scalability of the system. This will give the potential buyer an idea of the longevity of the site and its assets, and allow them to make financial forecasts for the business.

- Comparative Cost — your research will have revealed upper and lower sales prices for sites in your market. Now’s the time to go back top the notes you made about those sales, and compare your site with those. Does your site tick all the boxes? Does it lack certain aspects that appear to be desired by buyers? Where are the gaps?

This assessment should give you a clear picture of the way a potential buyer will see your site, as well as what its special features — and pitfalls — are. You should have some idea of a reasonable price that you can expect to receive for your site as is. You should also have a collection of valuable documentation that supports your valuation, but for one aspect: As Rob May reveals, “Humans respond well to social proof, so by showing similar websites that have sold for a certain price, a seller can usually get a similar price for their own site.”

But, are you happy with that price?

If not, the next step is to look closely at the areas in which your site lacks, by comparison to others in the same market segment. Can you address any of these factors, and in doing so, remove a potential hurdle to the site’s sale. If, when you considered the site’s potential, you listed a few ideas for improving the site’s revenues, could you implement any of those ideas?

Ultimately, Chris advises all site sellers to ask themselves “what’s the opportunity cost of not having the money for the sale in your pocket? If you’re going to sell a site for $50,000 what could you do with that money to earn you yet more money, what opportunity would you put that money into? If it isn’t more than what the site already makes you, then you’re asking for too little money. You need to increase your price.”

Once you’re happy with the price, and you’re ready to sell, the only thing that remains is to find a buyer. Choosing a sales forum — or approaching a potential buyer — involves a raft of considerations that we don’t have space to go into here, but good advice can be found in this Webmasterworld post, and on Yaro’s blog, in a post entitled How to Sell a Web Site.

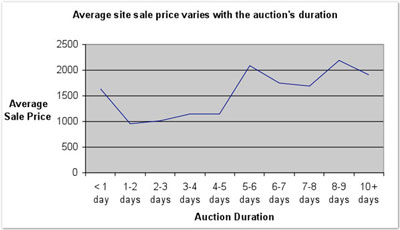

One point to consider, though, is the duration for which you hold your auction. Buyers are frequently advised to act quickly when they find a site they want to buy, or risk missing out on the sale. But interestingly, we’ve found through the SitePoint Marketplace that auctions that have a longer duration achieve, on average, a better sale price than their shorter counterparts.

The question of auction duration might be worth considering as you list your site for sale.

The Future of Web Site Sales

This article has aimed to provide a solid starting point from which you can begin the research involved in estimating the value of your web site. Though they can’t tell you what your site is worth, the experts who shared their thoughts through this article offer significant industry knowledge, and first-hand experience with web site trading.

When we asked them what the future for site selling looked like, they were unanimously positive. Dan summed it up best with the words, “The market for web sites is only going to increase. All you need to create a killer service now is a vision and a few good coders. The pool of high quality sites available to buy and sell is only increasing.”

Georgina has more than fifteen years' experience writing and editing for web, print and voice. With a background in marketing and a passion for words, the time Georgina spent with companies like Sausage Software and sitepoint.com cemented her lasting interest in the media, persuasion, and communications culture.