Google claims an amazing 10 million pages for the search term how much is my web site worth. If this is the question you’re asking, you’re not alone! This article will let you in on some valuation secrets to help you judge with accuracy the value of your web business, be it a blog or site.

We discuss the accountancy behind the figures, the math behind the valuations, what adds value to a site, how financial statements are reconstructed for sale valuations, and finally, the main business models and how they are valued by buyers. We’ll demystify the buying-and-selling terms beloved of accountants, but if you find yourself confused by any of the business usages encountered along the way, feel free to check out this glossary. If you’d like to skip straight to getting a rough idea of your site’s value, check out this website valuation tool.

Heading for the Ball-park

Maybe you’ve recently bought a site, or you’re an entrepreneur made good under your own steam – and now you want out. How much will you get for selling your web business?

There’s no single correct answer, as we’ll see. Valuing a site is a tricky business. Site prices aren’t set in stone; they vary based on buyer, market sentiment, how the sale is presented, and more. There’s no universal formula and there are no comprehensive and accepted standards for valuing sites – but we can make an educated guess.

And it is vital to make that educated guess. It’ll come as no surprise that there is a time-and-money cost to the wholesale process. This ranges from the time spent collating data for interested buyers to listing fees at auction sites. Without at least a rough idea of what is likely to be achieved at auction, you’re not in a position to know whether it’s worth going down that road. You may also need a “ball-park figure” for these reasons:

- to determine a fair BIN (Buy It Now) price

- to set an auction starting price or reserve that won’t be perceived as unrealistic

- to decide whether the value is high enough to get a broker or lawyer involved

- to decide where and how to promote the sale – some marketplaces are economical only for higher sale prices

- to reach an agreement to buy out a partner

- to ensure against underselling – and to help achieve the best price possible!

NOTE: Formal Valuations

There are also formal reasons where a valuation may be required:

- for tax purposes: for example, in the US, the IRS requires annual valuation of assets held in pension plans

- in divorce, probate, or other legal proceedings

- for accounting purposes: offering stock options, insurance valuations, economic damage valuations, and the like

These valuations are conducted by accountants, but, of course, may not reflect the price achievable at auction.

People obtain this ball-park figure in a number of ways. Some go to professional valuers, some use self-proclaimed “experts,” some rely upon their local accountant, and some use a multiple they’ve seen mentioned somewhere. We’ll have a close look at the valuation options now. However, before we go any further, it’s worth emphasizing that for the purposes of selling a site, the appraisals that you should be most concerned with are those of your target buyers. Period.

Valuation Options

First, let’s clear one thing up: there are a lot of myths about valuation out there. This situation is perpetuated by the proliferation of valuation tools on the Internet. Some of these tools are automated systems where you provide details and you are given a price on the spot, while others charge for a “professional” 32-page valuation by an expert. It’s worth taking one or two for a test drive, if only to see that you’ll gain nothing from the valuations.

If you try a few of these appraisal sites, you’ll likely find that each one puts a completely different value on your business. For example, see this valuation tool’s strange result: that http://www.google.com is worth $819 million dollars more than http://google.com. Now, would you trust that tool’s evaluation of your site?

Some estimates may vary by a factor of 10,000% or more. Why such a disparity? Because, despite the hype, many of them operate in a way that isn’t much different to operating with tarot cards or astrology charts. But they’ll take your money, thank you very much.

Ah! you argue. But some of them charge nothing at all. Like the ubiquitous Dane Carlson’s blog valuation tool. If it’s altruistic, it’s got to be accurate, right?

Well … dig a little deeper. The tool consistently offers simply astronomical valuations – so guess what? Webmasters and bloggers who love boasting about value give this tool a link back. At last count, that tool had a quarter of a million such linkbacks! The valuation tool’s game isn’t all about money earned via charging fees. If they don’t charge you, it’s probably all about linkbait.

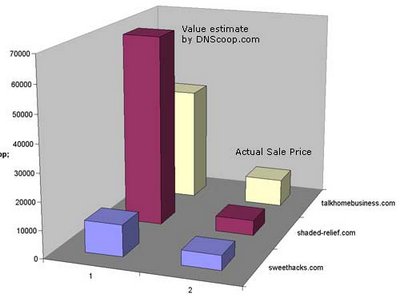

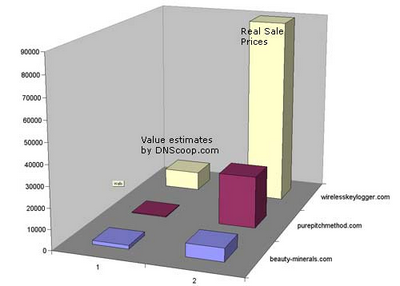

One of the best-known free valuation sites is dnScoop. dnScoop asks for no more information than your domain name. Yes, even your site’s earnings seem to be irrelevant to its calculation of worth. These charts show some sample dnSoop valuations for sites against the prices those same sites achieved at auction.

There are also plenty of individual self-appointed experts around who are happy to give their opinions on value. They spend their days commenting in forum threads, contacting sellers to offer their services, and generally claiming to be gurus in the fine art of valuation. Yet, strangely, they won’t put their own money where their mouths are.

At the end of the day, for the site seller, the only valuations that matter are those done by people who have both the desire and liquid funds to buy the site.

The maximum price that the seller’s most optimistic potential buyer has in mind is the price you, as the seller, want to target. You may never know that exact figure … but that’s your target, nonetheless.

And it’s with this target in mind that, with a little help from some friends, I developed EBizValuations, a tool that we believe to be insanely useful.

I know, I know. Another free site valuation tool, right? Wrong.

This tool values your site based on what hundreds of similar sites have actually sold for. As it’s a tool that is grounded in reality, it can offer an reliable estimation of your web business’s value. It can help a sellers decide whether to list their site for sale or not, and it can help buyers in their evaluation of a prospect.

The tool delivers more than just a final number – it uses input from brokers, professional business valuers, buyers, sellers, accountants and other experts to generate an extensive report. It can therefore be used to gain a deep understanding of the listed site and provide considerable due diligence information and guidance on where value may lie outside of the quoted figures. The resulting report explains the caveats, the level of confidence in each price prediction (some sites are easier to value than others) and some background to the valuation.

Principles of Business Valuation

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett

And perhaps no group of people likes to make things more difficult than accountants. It’s a commonly held opinion that they introduce a lot of complex-sounding terms to make themselves look clever and enhance their perceived value!

Here, we’ll walk through the terms you might meet in your site-valuation endeavors to demystify them and explain how they work. And if you’re keen to do any calculations for yourself, we’ve reduced it all to some very simple spreadsheets you can download. Whether you want a Discounted Cash Flow, Net Present Value, or a Balance Sheet, don’t miss these killer tools – all of which are free!

NOTE: Businesses and Web Businesses

The oddity is that a lot of the web sites coming up for auction are not businesses. They are advertised as sites that can be made into businesses; this means that they don’t already make a profit, but have the potential to make a profit. These sites are 90% less likely to achieve a sale than proven businesses and their valuation is even more subject to the vagaries of the buyers’ mood on the day. Going by the number of these that come up for sale, it appears that there’s no shortage of overly optimistic sellers.

Then there are vanity domains, the social make-more-friends widgets, tools, Squidoo lenses, and other assets not based on traditional web sites and not generating profit. The less easy it is to see future profits, the more a property’s valuation is at the whim of the buyer. As such, it’s difficult to provide rules to quantify their value.

Anyway, that’s enough of them. For the purposes of this article, we’ll deal solely with those sites that are being sold as businesses, not those that merely “have a lot of promise.” That said, here’s a useful link to a page devoted to converting your non-profit-making web site to a web business that buyers drool over.

Present Value of Future Earnings

Let’s roll our sleeves up and dive into valuation methods. It’s all well worth knowing – knowledge is power, after all – but if it really isn’t your cup of tea, just download the spreadsheets here and they’ll work the magic for you.

First, let’s have a look at some reliable business valuation facts:

- Valuation is a mix of objective and subjective tasks.

- It is very common for web site owners to value their sites far above real worth.

- The better the quality of the data (the earnings and traffic stats, for example), the better the quality of valuation.

- There are always external factors out of the control of the seller, such as interest rates, that affect the valuations buyers make.

- There is no one exact valuation for any business; value, like beauty, is in the eye of the beholder.

The reason average buyers invest money on a business is because they expect to reap some profit from it. They use some level of guesswork or skill to estimate future profit, and the amount of expected profit determines how much they are willing to pay now.

Let’s anticipate how these buyers might do this by unpacking this accounting problem. Here are two hypothetical businesses that are both selling for $10,000, and both will have the same residual value after four years.

- Fast Movers Ltd: FML is expected to generate $5,000 of profit in the first year after takeover, and no profit for the three years following.

- Slow Movers Ltd: SML is expected to make nothing in the first three years, but $5,000 in the fourth year.

If you encountered this scenario in the real world, you should immediately ask yourself why the two sites are being sold at the same price. Clearly FML’s new owner has the use of $5,000 (the first year’s profit) for three years, which is a perk that SML’s new owner won’t have. So either FML is priced too low, or SML is priced too high.

This exercise demonstrates that it’s not just the amount of expected profit, but its location in the future timeline that determines current value. The more heavily weighted towards the current point in time, the more valuable those future cash flows will be to the business buyers and the more they’ll be willing to pay to own them.

The calculation does become more complex, though. Consider FML’s and SML’s projected profits in a different situation:

| FML ($) | SML ($) | |

|---|---|---|

| Year 1 | 1,672 | 4,538 |

| Year 2 | 3,845 | 1,012 |

| Year 3 | 6,427 | 6,201 |

| Year 4 | 2,355 | 2,526 |

| Year 5 | 979 | 1,001 |

| TOTAL | 15,278 | 15,278 |

It’s not so easy to immediately spot the better buy now, is it? That’s where a handy accounting trick comes into play; it’s called Present Value (PV).

Because there’s a time value to money, future cash flows can be discounted to a current value. To get $1,000 next year you may need an investment of $910 today. But to get back $1,000 a whole two years from now, it may take an investment of only $800 today. That $910 and $800 are PVs for the future return of $1,000 (in 12 and 24 months respectively).

In other words, for a given rate of interest it is possible to work out how much would be required today to generate $1,672 in the next 12 months. Since that’s the figure FML is going to generate in the first year, we have effectively reduced FML’s first year’s profit to a PV.

By applying that same PV calculation, it is possible to establish a sum required now in order to generate $3,845 in 24 months, or $6,427 in 36 months, and so on.

We can therefore calculate a PV to all FML’s expected future profit. Adding them up then gives us a total of today’s value for all those future profits. That’s what we expect to flow in.

What is flowing out, don’t forget, is the initial investment of $10K. Subtracting the initial investment from the Present Value gives us Net Present Value (NPV). It’s a figure we can compare against similar computations applied to SML’s projected profits. Consequently, the business with the higher NPV is the better buy.

Calculating Net Present Value

NPV can be derived using the following formula:

NPV = CF0 + CF1/(1+r) + CF2/(1+r)2 + CF3/(1+r)3

(where CF1, CF2 are the cash flows in year 1, year 2 and so on; R is the discount rate (the “interest rate”)

That said, the FML–SML example provides a comparative situation that is very rarely the case in real life. Even so, the usefulness of the tool isn’t in any way compromised by the fact that the buyer is usually judging a business on its individual merits. Once the buyer has arrived at projected profit figures he or she is comfortable with, it’s a reasonably simple continuation to plug those figures into the formula to arrive at an NPV for that business’s future profits. The NPV goes up if a quantity of earnings is brought forward in time, and it goes down if earnings are postponed. Remember that all these earnings figures are projections, and reside in the buyer’s mind.

The other key input in NPV arithmetic is the interest rate. The higher the interest rate the buyer wants to apply, the lower the NPV and vice versa. That’s because the profits are being discounted by the interest rate; the higher the rate of discount, the lower the value arrived at.

NOTE: More on NPV

There’s a bit more to NPV than discussed here. For example, interest rates don’t always stay the same across several years; it’s not accounting profits that are used in the calculation but the cash flows; there’s a terminal value of the investment to be plugged in … but for the really keen, here are a few links:

- Wikipedia’s Net Present Value page

- Sporkforge’s calculator

- Sugar Project’s Feasability Study

- TheStreet.com’s article on dicounted cash flows

- Fool.com’s article – pay particular attention to the critical mass argument

Discounted Cash Flow

In the calculation of NPV, the core inputs were the cash flows and the discount rate. The cash flows are a projection, but where does the Discounted Cash Flow (DCF) come from?

This discount rate is provided by the buyer and reflects the risk perceived in the investment. When buying a rock-solid, well-established, blue-chip company, a buyer may be willing to use a rate of 12% per annum, whereas 80% per annum might be required for an internet business perceived as particularly risky.

There is no right or wrong discount rate. Each buyer uses his or her own rate, and for a given web site, different buyers may use different rates to arrive at completely different figures for what that site is worth to them.

Internal Rate of Return

We’ve seen the outline of how Discounted Cash Flow (DCF) works to give us NPV. There is one other way of discounting future cash flows; it’s called the Internal Rate of Return (IRR). The IRR is the rate of return/interest rate at which the NPV equals zero.

The IRR is not the favored method of calculating value for several reasons – use an MIRR if you really have to. For one, it doesn’t suit some projects – think of government projects, where there is just cash outflow and no inflow. But we’ll cover it for reasons of thoroughness.

Remember the discount rate applied to the NPV calculations from earlier? It’s a pre-decided rate that is applied to the calculation. When that rate is plugged into the NPV formula, we end up with either a negative or positive NPV. Under IRR, this rate is left to adjust to whatever level it needs to reach to ensure that the NPV equals $0. The level it reaches is the Internal Rate of Return.

Of two competing investments, the one with the higher IRR is the better investment.

Fair Market Value

Web properties valued formally for accounting or legal purposes are usually valued at what’s called Fair Market Value (FMV). FMV is the price at which the property would sell at a hypothetical transaction between a buyer and seller who are aware of the facts and are both acting voluntarily.

Accountants can’t just put any value to a business’s assets. They are governed by a lot of rules on how they can value assets for purposes of use in the balance sheet, statements to a stock exchange, and so on. When you see a web site listed in a balance sheet, the figure quoted is likely to be the FMV as governed by international accounting rules that go into these matters in great and boring detail.

But while FMV is great for all these Balance Sheet reasons, it’s not what you’d really expect a site to achieve at a real sale. FMV does not take into account that:

- a buyer may make due-diligence findings that affect the price

- the projected earnings used in real sales situations could differ considerably from the historical earnings used for FMV calculations

- a seller’s proper positioning and clever marketing can push the price upwards

- sellers taking a longer view and deferring part of their payment contingent on the site’s continued success can get a higher price

- a synergistic buyer would pay a premium for the efficiencies he or she recognizes in the merger

Therefore, a valuation shown in a company’s books may bear no resemblance to the real value of a site. The Fair Market Value is not a fair market value.

Do the complex calculations, spreadsheets, specialist accounting programs, and a PhD in Merger & Acquisition accounting underpin every valuation? Hardly. Many buyers wouldn’t be able to tell a Discounted Cash Flow from a Dyspeptic Chicken Fajita. However, a formal understanding of the principles is not a prerequisite for the experienced buyer. This buyer may reach competitive value conclusions based on no more than gut feeling, but that’s instinct backed by an intuitive understanding of what the competition is likely to pay. In value terms, it adds up to the same difference.

If your eyes glaze over at all these computations, take this one thought away: in most cases, the expectation of future profit – and the quantity and timing of that profit – is the sole driver of valuation.

Adding Value to a Site

Bear in mind that this whole article is intended to offer the buyer’s perspective. Knowing what factors influence a given buyer’s perception of value puts the seller in a stronger position to control the sale and improve the selling price.

So what are assets that buyers like? Here’s a list that contains some obvious examples, as well as some more obscure ones. Sadly, there’s a twist in the tale for sellers … but, first, let’s look at the motivators that help push a site’s valuation up:

- prime real estate, which is a good domain name (preferably also registered in other TLDs as a precaution against misuse)

- a long, unbroken WHOIS history – an aged domain that has never been allowed to expire

- aged links, particularly from the big directories like the ODP and “grandfathered” Yahoo (before it started charging)

- an aged site – the longer the earnings history, the level of traffic, the inward links, and the statistics and data to prove it all, the better

- a large quantity of links from a wide range of domains – for example, some buyers tend to place extra value on links from .edu and .gov domains

- brand and goodwill – usually translates to a loyal visitor base and trust, both of which have value to advertisers

- first mover advantage

- the page rank of the top pages of the site and, to a lesser extent, the site’s ranking in traffic monitoring sites such as Alexa, Compete, and the like

- low risk; for example, plenty of evergreen content in a subject that’s not fast changing

- high threshold to impede new competitors

- high flexibility – anything from content to technology, scripts, and relationships can be easily managed, migrated to a new owner, or moved to a different host if required

- quality databases, such as a large database of double opt-in subscribers eager for every newsletter sent out

- a high cost to recreate the site, which acts as a high barrier to entry

- a quality customer base that places regular orders

- low expenses relative to gross profit – a proxy site with a bandwidth bill of 80% of revenue represents a high risk, as a small increase in costs could make the whole enterprise unviable

- large amounts of stock in good resale condition

- large numbers of visitors and page views – larger sites are seen as more stable

- a demographic valuable to advertisers – 50,000 lawyers a month looking to subscribe to a trade monthly beats 200,000 teenagers looking for the latest news on a pop diva

- quality content, well-developed functionality, a carefully built up community with a large participation

- well-established partnerships and joint ventures

- a secure source of earnings that doesn’t require much regular work – Adsense would be seen as a lot less onerous than the blogging, pay-per-post model

- multiple sources of such earnings to give further security

- opportunities for buyers to further monetize the site

- an honest, professional presentation by the seller – exaggeration, boasting, or quoting server hits as unique visitors puts buyers on guard and raises their risk perception

- guaranteed continued seller involvement post-sale

There are many more – from stickiness to SEO – but lest we forget, what’s probably the most important is how the seller presents the sale. A professional sales pitch is vital – a good description of the business and what it does, where the money comes from and the breakdown of earnings, traffic and referrer stats, reasons for sale, and all the other core information (there are more tips here). Otherwise, buyers may not even bother to stop and consider the business for sale.

The Bad News

Consider a large content site with thousands of pages of unique and high-quality content. It’s long established and has lots of “natural” inward links because it’s a genuinely good resource. The site’s sole revenue stream is Adsense and it makes $5,000 a month. Now, if current market sentiment is paying in the range of 24 months’ net earnings for similar sites, this site is likely to fetch:

Earnings x Multiple = Price

24 x $5,000 = $120,000

Yet the seller is aware that this huge amount of quality content doesn’t come cheap. If the buyer were to commission similar content, it would cost over $100,000.

There is also the strength of the tens of thousands of inward links, the high page rank, the large number of unique visitors, and the single-word memorable domain name that also attracts its own type-in traffic! How is all of this valued in any appraisal?

Here is the bad news for sellers: it isn’t. Those assets contribute no more than what’s already been added up.

The assets form the infrastructure of the business. Without them, there would be no earnings. Without the quality content, there wouldn’t be so many inward links, there would be no PR, and there would be no large traffic from search engines. Without the type-in domain name, further traffic would be lost. With all that traffic gone, there would be nobody to click the Adsense ads and there would be no earnings. The value of all those assets was reflected in the earnings. It’s already been counted.

What then of age of domain, length and consistency of earnings, and other assets that arguably don’t contribute directly to traffic and earnings? The value for these assets is reflected in the multiple. Again, it’s already been counted.

The longer the history, the more secure the investment is seen to be, and the higher the multiple it subsequently commands.

Since the Price is a product of the Earnings and Multiple, and all assets underpin either Earnings or Multiple, there is no further value to the assets.

So, contrary to sellers’ claims, the assets responsible for earnings don’t add any further value to the business than what’s been counted. More site-selling myths are debunked here.

It is in the nature of the seller to overprice their own site. Their next argument may well be that the earnings don’t reflect the full value of the assets. And that’s entirely possible. However, it’s a claim that any seller can make, that most sellers do make, and it’s rare for a buyer to accept the seller’s prejudiced opinion. It is in the buyer’s interest to suspect that any further earnings to be extracted out of the business can come only at a huge cost in time or money that would make it uneconomical to pursue.

Where the seller believes there’s substantial additional profit to be generated easily from the existing assets, it would be less of a task to actually ramp up earnings and demonstrate the figures than to convince skeptical buyers to believe a figure plucked out of thin air.

So what are some ways the seller can add value?

- Sharing risk – if the seller shares the risk with the buyer by taking part of the payment contingent on the site achieving some predefined goals, there are grounds to negotiate a higher multiple.

- Providing finance – where the seller is willing to take payment in stages or instalments, the buyer benefits from the time value of that cash; that’s a good basis for arguing a higher price.

- Providing expertise – if the seller undertakes to provide ongoing consultancy services, or contribute via some other skill, it’s reassuring to the buyer. Having that first-hand experience of the business on hand is worth a premium.

- Offering part ownership – sellers often take a share in a new, merged business. They may lay down conditions or take out warrants (stock options) to avoid dilution of their share through further financing, but the fact that they still have a monetary interest in the business is reassuring enough to nudge the achievable price higher.

- Agreeing not to compete – in some cases, a no-compete clause in the Sale Agreement can make a big difference.

Reconstructing Financial Statements

Balance Sheets (BS), Profit and Loss Statements (P&L, also sometimes called Income Statements), Cash Flow Statements, and so on, are some of the statements that help run a business and comply with the law. You can create your own balance sheet or P&L account using these easy spreadsheets.

We’ll discuss here what these financial statements are, where they are useful, and why the standard statements need to be reconstructed for the purposes of valuing a business.

NOTE: Beware the Terminology Trap

Remember that terminology can differ between countries, between cultures and between professions. For example, in North America the term “revenue” is often used interchangeably with “turnover”, whereas in the UK it means “profit”.

Why redo the financial statements? Earlier, we’ve covered why the Fair Market Value (FMV) of a site differs from its fair market value. To recap, FMV calculated by accountants is done to meet legal formalities and it rarely reflects real fair market value of the type a buyer would pay. Usually – but not always – the FMV is less than the realizable price, as accountants are incentivized to value conservatively.

Other statements that a business prepares, notably the BS and P&L, are prepared to minimize its tax bills while complying with strict legal curbs on how these statements should be prepared. The P&L is meant to show a fair summary of the business’s trading over the year, and the BS is meant to be an accurate reflection of the state of the business’s finances on a specific day.

These statements impact considerably on a business. The figures that appear in them end up contributing to credit score and determining the interest rate the business pays on its overdraft. These statements are submitted to the tax authorities and are core documents in the calculation of tax liability. Governments also use these final accounts to compile national statistics that affect the formation of further policies and taxes. And the other business influences they exert are too numerous to mention.

Businesses are motivated, therefore, to tailor these statements to their convenience. They may look for ways to show higher expenses (therefore lower taxable profits) or to boost the values of fixed assets on the BS (thus improving their credit scores). They’ve got to keep any such doctoring within strict rules governing these matters, but a good accountant can save a business millions in tax just by controlling how this information is presented.

Not all financial statements come from a business’s annual accounts. Sometimes they’ve been put together for other reasons, such as:

- probate

- insurance valuations or claims

- asset protection (pre-empting a threat such as divorce)

Whatever the original purpose behind the statements, the business buyer has to see through those adjustments made purely for tax or other purposes and come to his or her own conclusions as to what the state of the business is (BS) and how it fared over the year (P&L). To do that, it’s necessary to reconstruct those financial statements upon which to base a decision.

Governments may also offer various tax breaks, such as tax incentives for investment in IT, deferred tax for infrastructure costs, or reduced tax for research and development expenditure.

Let’s take as an example a company with $20,000 in sales, and the following Profit and Loss statement:

| Sales | $20,000 |

| Cost of Sales | $400 |

| Gross Profit | $19,600 |

| Expenses | |

| Rent | 500 |

| Electricity | $300 |

| Travel | $2,000 |

| Employee’s Salary | $6,800 |

| Net Profit | $10,000 |

Let’s say the business is based in a country with a 20% corporation tax rate. Based on the information so far, its tax liability is, of course, $2,000.

The business’s accountant points out that it can save some tax if its IT equipment is depreciated by the full allowed 25% (the current value of the equipment is $8,000). She also points out that the government is giving small businesses a tax break if based in an area of high unemployment, so this company is eligible for a flat allowance of $4,000. The company also invested in some research and development over the year, and is eligible to reduce taxable profits by a further amount of $4,000.

| 25% of $8,000 | $2,000 |

| Area Allowance | $4,000 |

| R&D Allowance | $4,000 |

| Total allowed deductions | $10,000 |

That takes the company’s taxable income to $0 – and makes the owner of the company very happy.

During the course of the subsequent year, however, he decides to sell. The prospective buyers’ first impressions are of a company that makes no profit at all. But, on delving into the figures, they realize that they need to add back those deductions that were made for tax reasons, and they need to add back some of those original expenses to arrive at the true profit the business made last year.

But it’s not always that the reconstructed figure shows a higher profit. The prospective buyer may apply his or her own valuations to the assets and apply a larger depreciation for depleted assets that need to be replaced, or deduct a notional salary for the owner’s time that wasn’t accounted for earlier … and so on.

In conclusion, for low-value businesses, it’s hardly worth anybody’s time to redo the statements; however, no large business is sold without this recalculation done by the buyers’ due diligence team. No smart buyer would completely trust the seller’s accountant’s figures. And if there is a bank loan involved in the purchase, such reconstruction would be a prerequisite, a sine qua non.

Most web sites sold in the popular site-selling forums fall below the level where it’s economic to appoint expensive advisors to reconstruct financial statements. In fact, many of these sites for sale don’t have formal financial statements.

Where there is a statement of sorts, it tends to be more along the lines of a proft and loss statement, which demonstrates cash inflows (earnings) and outflows (expenses) over the course of the year. There is hardly ever a formal Balance Sheet unless the business had been preparing formal accounts.

The Income Statement presented is usually of a less than professional standard and almost never matches national and international accountancy conventions. Buyers, nevertheless, either plug the figures into their own spreadsheets to do a quick-and-dirty reconstruction … or do the reconstruction mentally if it’s a fairly simple business model without too many elements to consider. The most common deduction prospective buyers make from stated income is probably a nominal (notional) salary – an expense often overlooked by site sellers.

Valuing Your Own Site

Now that we know all the complex theories behind valuations, we’re going to return to the basics: the best indication of a price a site is likely to fetch can be gained from recent sales of similar sites.

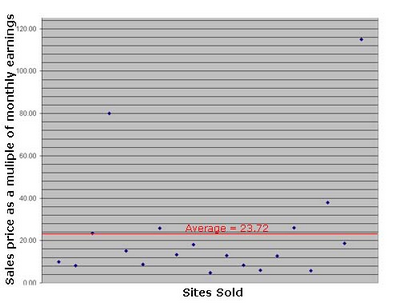

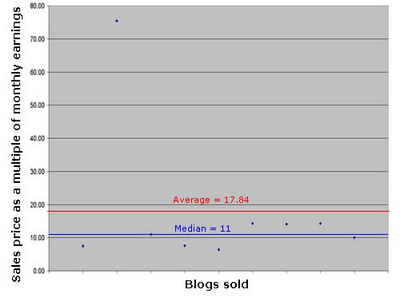

So we’ve taken data from several sales in various marketplaces and compiled some charts to indicate the type of multiples they go for.

Caveats

- Though this study’s results mirror a larger analysis, it needs to be remembered that the sample size here is small and samples are sales that happened in public.

- There is some subjective judgment involved in categorizing web businesses. Some content sites have blogs and forums; some forums have product sales or services.

- Some sites that apparently sold have been left out of the charts where deemed appropriate. This is particularly so when the seller complained that the buyer disappeared without payment, or where the earnings or price were too insignificant and the site was deemed to have been bought for the value of its domain or design rather the earnings.

- There is no standard way of calculating earnings; earnings figures underpinning the multiples here were taken directly from sellers’ claims, and were not verified by us.

- Only English-language sites were included in the study.

- All sale prices were under $100,000. Above that figure, the market may work slightly differently.

- Where prices are quoted as multiples, these are multiples of monthly earnings.

- Where the site has sold for a buy-it-now price, it may not reflect the maximum price open bidding would have reached.

Content Sites:

Content sites range in subject from technology and games to health, antiques and weddings. The “content” ranges from text and articles to video and images.

The average multiple of just under two years’ worth of income is, in reality, probably skewed by the fact that sellers often quote gross revenue as net profit. If we remove the top and bottom two sales in the above chart, we find an average of just 16.35 months of claimed earnings. This is lower than it was a year ago, in the middle of 2007, and may reflect the credit crunch and increased caution in the marketplace.

Blogs

The subjects of blogs range from health and celebrities to relationships and technology.

The lower average for blogs (around 11.25 if we remove the two extremes) reflects that the earnings figures sellers quote are usually gross rather than net, and that buyers appreciate the extra work that blogs entail and discount the price to reflect that.

Blogs are selling for about two-thirds of what they would realize if they were “pure” content sites. That said, the volume of blog sales has risen appreciably since 2007.

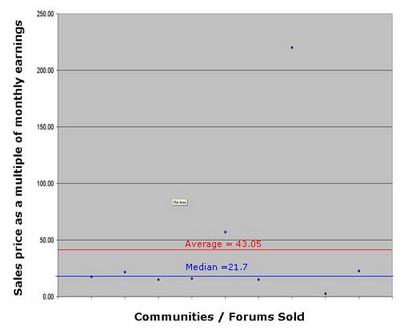

Forums and Communities

Forums and community-based sites focus on topic areas as far apart as automobiles, pregnancy, and gaming.

The much higher multiples that forums go for is surprising, until you realize that forums are difficult to monetize, and many sellers have zero or very little proof of earnings.

Also, most forum buyers are site flippers or otherwise experienced at managing and monetizing communities, and are therefore willing to pay a higher multiple of the unoptimized earnings. Removing the extremes in the above chart give us a much more realistic average of 23.5.

Proxies

Proxies tend to be seasonal and less used during school and college holidays. It’s also typical of proxy sites to be heavy on use of bandwidth. The low quality of traffic to proxies, the fact that by its very nature its visitors are actively looking to leave the site, the difficulty in monetizing proxy traffic in general, and the large volumes of traffic from countries not favored by advertisers leaves proxies low down the list of multiples. At under 5 months’ worth of earnings, the multiples are similar to what they were a year before.

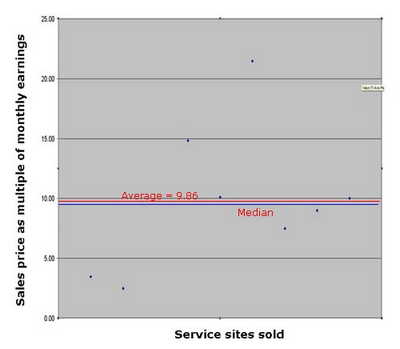

Service Sites

Service sites provide free image sharing, site hosting, and freebie services.

The much lower average of 9.86, compared with content sites and blogs, reflects that buyers are aware of the higher overheads (such as bandwidth), often not deducted from the claimed earnings.

Incentivized Sites

Paid to Click (PTC), survey, and toolbar installation sites perform even more poorly than proxy sites. At just 3.5 x monthly income it’s almost not worth selling for many sellers, as just shelving the site for a few months could see them earn more than an outright sale. And many owners do just that – running the site down rather than risk listing at auction and spooking the member base.

Product Selling Sites

These are strange beasts. Sites selling both physical and digital products keep appearing regularly in various marketplaces, but buyers seem reluctant to dive in. With shipping of physical products, there’s obvious geographical issues when pitching sites to a global audience, but even though that limitation doesn’t apply in drop shipping and e-product delivery, buyers seem wary about taking on a business involving dealing face to face with customers. Apart from the customer services adding to the overheads, there’s an element of fraud (chargebacks), management, PPC or other required skills, and an appreciation of how easy these businesses are to duplicate, all of which affect buyer enthusiasm.

Prices range from 1.8 x monthly revenue (for an ebook product) to 200 x monthly revenue for a physical product that comes with its own trademark and other IP rights.

There are some web businesses not included in any of the above categories:

Notes on Calculations

- These value calculations are not set in stone. Multiples vary based on market sentiment, supply of sites coming up for sale, number of buyers in the market, the synergies that buyers may recognize, timing, location of listing, credit offered by seller, form of payment, or the buyer’s mood on the day!

- The calculations are quoted as a multiple of earnings, since earnings are what buyers tend to be looking for.

- The main value buyers see in historical earnings is that they are often a guide to future earnings. It’s the expected future earnings that are of the most interest to buyers.

- Those future earnings can come directly from the site, from changes the new owner makes, or even from closing that site down (for example, if that site is the only competitor in a niche, you could expect increased business at your old site as a result of closing the newly acquired one) or transferring its assets!

Summary

Good luck with weighing up what your site is worth, and deciding upon its future! The considerations we’ve discovered should go a long way towards helping you decide whether to launch into selling your web business. If your assessment suggests that such a sale would be feasible and advantageous, the advice here will ensure that you gain the best possible price, and support you as you do so.

If you’d like to value your own site before selling it, or value a site you are looking to buy, don’t forget to try this valuation tool, which values sites based on the logic in this article. The business documents are a highly useful tool to adopt in your business practices, too. Some more terms associated with buying and selling web sites can be found in this glossary.

Other Useful Links

There is a lot of valuation misinformation on the Web. Here are a couple of articles that I recommend reading:

- a great explanation on the current value of future cash flows

- more commentary on how to value a web site

- a list of other valuation tools

Acknowledgments

Many thanks to Macro at SitePoint, who is probably the most active buyer at the world’s most used site-for-sale forums (SitePoint interviewed him here). And to oddsod at Webmasterworld, who has advised hundreds of people on selling their sites (some threads he has provided public expert advice can be found here and here). Then there’s Mark, whose advice is the official guide on one of the world’s oldest site-for-sale forums. Thanks also to Merkersarl and Foggy at DigitalPoint, Edman, hooperman, 3Six, and others at SitePoint; Peter T. Davis, long-time moderator of SitePoint’s Site-For-Sale forums and writer on site-flipping and domaining; Barry Dunlop at site brokerage firm MidasCode Ltd; sellmeurdomain and friends at Namepros; the three anonymous donors from DNF; Mike from iMarket Ventures, author of The Business End of Websites: Advertising Arbitrage and Website Valuation; and others too numerous to mention without whom this article wouldn’t have been possible.

Disclaimer: The valuations in this article and produced by the EBizValuations tool are not meant to be legally binding valuations that comply with guidance from the International Valuation Standards Committee, National Association of Certified Valuation Analysts Standards, Government Accounting Standards Board, Financial Accounting Standards Board, International Accounting Standards Committee/Board, Revenue Rulings 59-60 & 68-609, or any other national or international standard or recommendation. Should you require a valuation for any formal purpose, please consult the appropriate professionals.

Frequently Asked Questions about Website Valuation

How does website traffic impact the value of my website?

Website traffic is a significant factor in determining the value of a website. High traffic indicates that your website is popular and attracts a large number of visitors. This can lead to increased ad revenue, potential sales, and a higher ranking on search engines. However, not all traffic is equal. The quality of the traffic, such as the bounce rate, average session duration, and pages per session, also plays a crucial role in the valuation.

How does the age of my website affect its worth?

The age of a website can significantly impact its value. Older websites tend to have more credibility with search engines, which can lead to higher rankings. They also often have a more extensive backlink profile and a history of steady traffic, which can increase their value. However, the age of a website is not the only factor considered during valuation. The content, design, and revenue of the website are also important.

How is the revenue of my website calculated in the valuation?

The revenue of a website is a critical factor in its valuation. This includes income from advertising, product sales, affiliate marketing, and any other revenue streams. The consistency and growth of this revenue over time are also considered. A website with steady or growing revenue is likely to be valued higher than one with fluctuating or declining income.

How does the niche of my website influence its value?

The niche of your website can significantly impact its value. Some niches are more profitable than others due to their audience size, competition, and potential for monetization. Websites in high-demand niches with less competition are often valued higher. However, the profitability of a niche can change over time due to market trends and consumer behavior.

How does the design and user experience of my website affect its worth?

The design and user experience of a website play a crucial role in its valuation. A well-designed website with a user-friendly interface can attract and retain more visitors, leading to higher traffic and potential revenue. On the other hand, a poorly designed website can deter visitors and decrease its value.

How does the SEO ranking of my website impact its value?

The SEO ranking of a website is a significant factor in its valuation. Websites that rank high on search engine results pages (SERPs) for relevant keywords are likely to attract more organic traffic, which can lead to increased revenue. The quality of the SEO, including the use of keywords, backlinks, and content, is also considered during the valuation.

How does the content quality of my website influence its worth?

The quality of the content on your website can greatly impact its value. High-quality, unique, and engaging content can attract more visitors, increase the time they spend on your site, and improve your SEO ranking. On the other hand, low-quality or duplicate content can harm your SEO ranking and decrease your website’s value.

How does the domain name of my website affect its value?

The domain name of a website can significantly influence its value. A domain name that is short, easy to remember, and relevant to the content of the website can attract more visitors and increase its value. On the other hand, a long or complicated domain name can deter visitors and decrease its value.

How does the backlink profile of my website impact its worth?

The backlink profile of a website is a crucial factor in its valuation. Backlinks from high-quality, relevant websites can improve your SEO ranking and increase your website’s value. However, backlinks from low-quality or irrelevant websites can harm your SEO ranking and decrease your website’s value.

How does the social media presence of my website influence its value?

The social media presence of a website can significantly impact its value. A strong social media presence can increase your website’s visibility, attract more visitors, and improve your SEO ranking. It can also provide additional revenue streams through advertising and partnerships. However, a weak or non-existent social media presence can decrease your website’s value.

Clinton Lee ("FruitMedley Post" on the forums) has been "playing" business since the age of sixteen. Except for a brief stint working for a bank, he has spent most of the last few decades founding and running several businesses -- from a school to an IT company to web sites. He shares what he's learned about online businesses at his Work From Home site.